Definition of Algorithmic Trading

Algo-trading, or algorithmic trading, is an automated trading system where buy and sell orders are executed based on pre-defined rules, set by computer programs (Algorithms.) While these algorithms tend to consider factors like price, they can also analyze timing and volume. Once market conditions align with the algorithm’s criteria, the algo-trading software executes buy or sell orders.

For instance, a basic algorithm might dictate:

- Buying 20 BTC when the 10 day moving average surpasses the 30-day moving average.

- Selling 20 BTC when the 10 day moving average falls below the 30-day moving average.

However, in practice, algo-trading involves far more intricate rules and conditions to craft a formula for profitable trading.

Why Algo-Trading?

Traders utilize algo-trading for numerous reasons:

- Speed and frequency: Algo-trading enables rapid and frequent trading across entire portfolios, impossible with manual orders.

- Best prices: Instant orders secure optimal prices and minimize slippage risk.

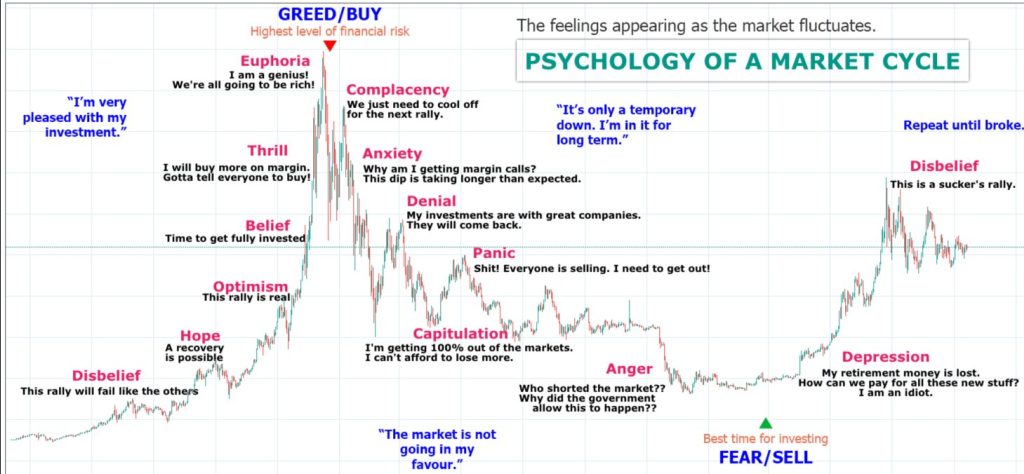

- Emotion-free trading: Removing the human element reduces the likelihood of errors or emotional reactions to market fluctuations.

- Liquidity and predictability: Algo-trading fosters more liquid and predictable markets by responding to emerging conditions programmatically.

In the 24/7 cryptocurrency markets, algo-trading offers additional advantages. Traders can avoid missing opportunities or facing loss risks while offline, making it a valuable tool even for those who prefer manual trading.

Adaptability and Suitability

Algo-trading suits various trading strategies:

- Arbitrageurs leverage algorithms to optimize order efficiency, capitalizing on incremental price differences.

- Short-term traders and scalpers utilize algo-trading to profit from minor market movements, ensuring high-frequency execution and mitigating loss-chasing risks.

- Market makers employ algo-trading to maintain sufficient liquidity depth in the market.

Moreover, traders use algorithmic trading to backtest strategies, ensuring consistent profitability.

Risks and Considerations

While powerful, algorithmic trading comes with risks:

- System downtime or network outages can disrupt trading operations.

- Human errors in algorithm programming necessitate rigorous backtesting to validate expected behavior.

- Algorithms lack adaptability to unforeseen “black swan” events, underscoring the need for human intervention in such situations.

Despite these risks, algo-trading remains a pretty potent tool for optimizing trading strategies, particularly in today’s fast-paced markets. Especially ones that are open 24/7.

One Comment

Comments are closed.