What is Yield Farming?

Yield farming is a innovative concept in decentralized finance (DeFi) that involves leveraging cryptocurrencies to generate passive rewards. It encompasses various strategies such as staking, lending, and liquidity mining. Unlike traditional methods, yield farming entails dynamically moving assets across platforms to capitalize on optimal reward rates. While these techniques typically lack lockup periods, premature token redemption may incur fees.

Liquidity Mining and LP Tokens

Liquidity mining, a cornerstone of yield farming, harnesses automated market maker (AMM) technology to enable decentralized cryptocurrency trading. Token holders contribute liquidity to pools and earn additional tokens as incentives. These liquidity provider tokens (LP tokens) represent investors’ shares in the pool and can be redeemed for the deposited cryptocurrencies. In some cases, LP tokens possess intrinsic value and can be staked for enhanced yield potential.

Exploring Yield Farming Strategies

Yield farming encompasses three primary strategies: staking, lending, and liquidity mining.

- Lending: In lending, investors loan cryptocurrencies to borrowers and receive rewards based on the interest and fees generated from the loans. Platforms like Compound Finance are popular among yield farmers for lending strategies.

- Staking: Staking involves locking tokens on decentralized exchanges like PancakeSwap. These locked assets contribute to the network’s consensus mechanism and transaction validation. Investors engage in staking across various platforms and cryptocurrencies to optimize rewards.

- Liquidity Mining: Liquidity mining is the most prevalent yield farming technique, consisting of automated market makers, liquidity providers, and liquidity pools.

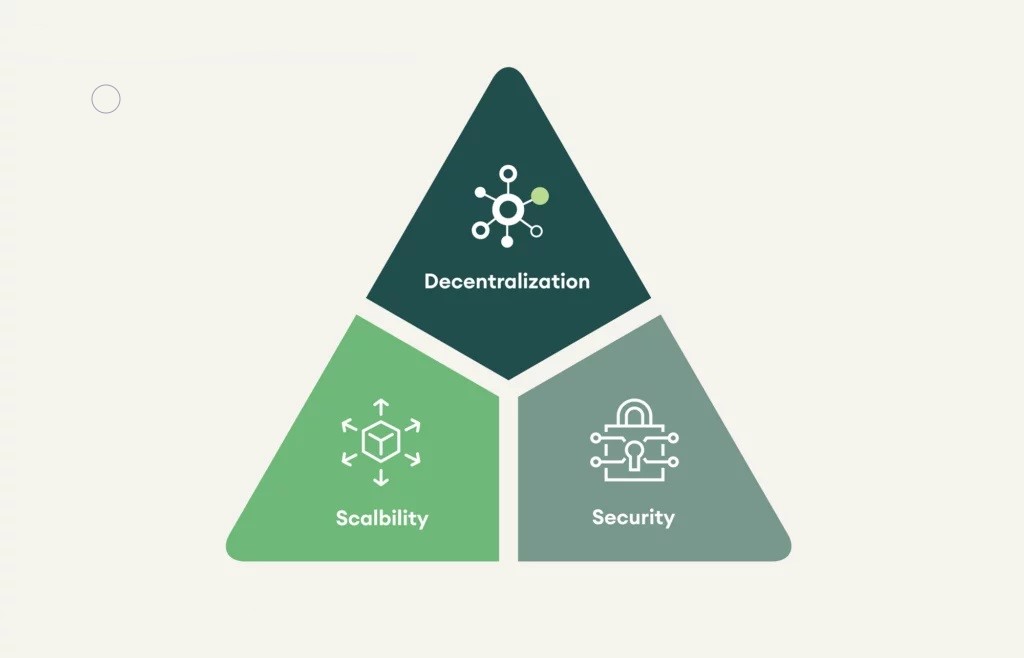

- Automated Market Makers (AMMs): Unlike centralized exchanges with order books, AMMs utilize algorithms and smart contracts to facilitate automated transactions, eliminating the need for third parties.

- Liquidity Providers (LPs): LPs deposit tokens into pools and receive rewards based on the liquidity provided. Stablecoins like USDC, and DAI are commonly used for liquidity provision.

- Liquidity Pools: Liquidity pools store multiple cryptocurrencies in smart contracts and are tapped into whenever traders execute transactions on decentralized exchanges.

Yield farming can be likened to purchasing from a vending machine. The machine, akin to a liquidity pool, requires suppliers (liquidity providers) to stock it with cryptocurrencies (snacks). As users engage with the machine, suppliers earn a share of the profits.

How Are Yield Farming Rewards Calculated?

Yield farming rewards are determined by each decentralized exchange’s unique reward system. For example, an investor depositing liquidity into an ETH/USDC pool might receive returns in ETH or an LP token like ETH-USDC.

Typically, yield farming returns are annualized, allowing farmers to project their earnings over a year. These returns are often presented as either an annual percentage rate (APR) or an annual percentage yield (APY), with APY factoring in compounding while APR does not.

Several factors influence the calculation of APY, including the 24-hour trading volume and total liquidity of a cryptocurrency. Network congestion and competition also play significant roles in determining potential yields.

Yield Farming Platforms

Several yield farming platforms are available in the DeFi landscape, including:

- UniSwap: UniSwap, founded in 2018, is a leading decentralized exchange facilitating permission-less trading of ERC-20 tokens. It supports liquidity mining, allowing users to create or join liquidity pools. Unique to UniSwap is the ability for liquidity providers to set target price ranges, influencing their rewards based on price movements.

- PancakeSwap: PancakeSwap operates on the Binance Smart Chain, offering various BSC cryptocurrencies for swapping. It features a robust liquidity mining program where liquidity providers earn rewards in the platform’s native token, CAKE, which can be staked for additional earnings.

- Compound Finance: Compound Finance, launched in 2018, automatically compounds deposited tokens, making it a lucrative yield farming option. Users lend their tokens and receive cTokens in return, which can be traded or reinvested into pools. Compound also introduced its governance token, COMP, allowing users to participate in platform governance.

Risks of Yield Farming

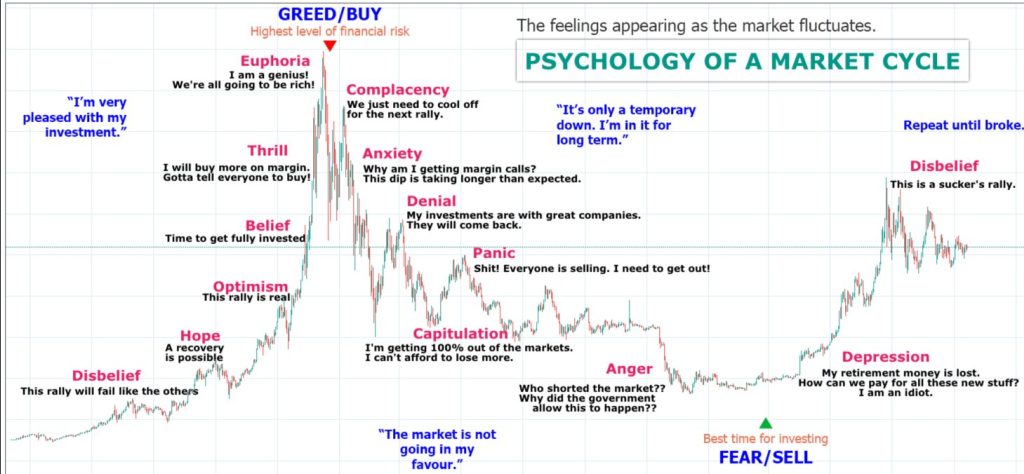

While yield farming presents earning opportunities, it also entails risks:

- Regulatory Risk: DeFi operates outside regulatory oversight, but increasing popularity may attract government scrutiny, potentially leading to platform shutdowns and fund losses.

- Smart Contract Hacks: Smart contract vulnerabilities can result in hacking incidents, leading to significant cryptocurrency losses on decentralized exchanges.

- Impermanent Loss: Yield farmers may experience impermanent loss due to cryptocurrency price volatility, impacting profits when providing liquidity to pools.

- Rug Pulls: Rug pulls, or liquidity thefts, are common scams in yield farming where developers lure liquidity providers with high rewards but withdraw real currencies, leaving farmers with worthless tokens.

One Comment

Comments are closed.