Whether you’re diving into cryptocurrency, stocks, real estate, or other assets, you’ll often hear the terms bull market and bear market. Simply put, a bull market is when prices are rising, while a bear market is when prices are falling. These terms aren’t typically used for daily fluctuations but for longer periods with significant trends.

What is a Bull Market?

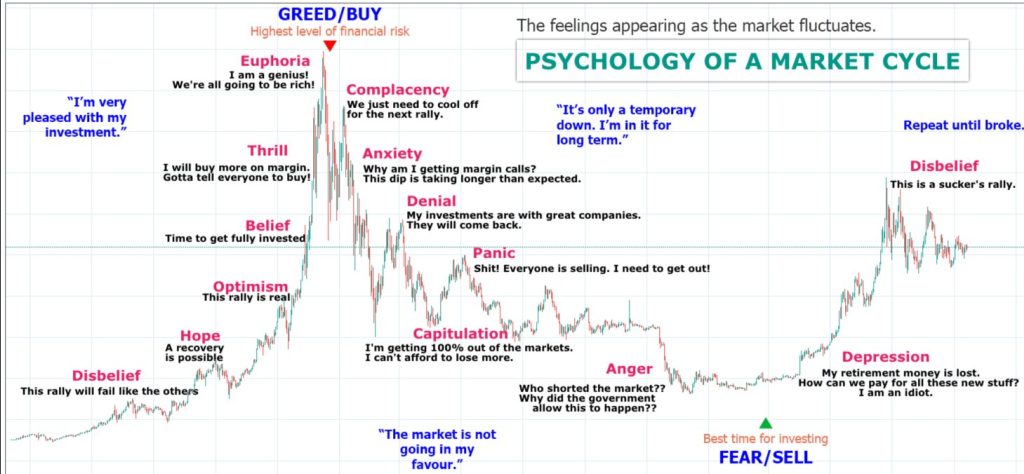

A bull market, or bull run, is a period where most investors are buying, demand exceeds supply, market confidence is high, and prices are climbing. When you see prices steadily rising, it’s a sign that investors are optimistic or “bullish” about further increases. This optimism creates a positive feedback loop, drawing more investment and pushing prices higher.

Investors who believe prices will keep rising are known as “bulls.” Their confidence can drive the market upwards, as more people invest, hoping to benefit from the trend. A key strategy for some is to gauge this market sentiment — how optimistic investors are about future prices.

Signs a Bull Market is Ending

Even in a bull market, there will be dips and corrections. It’s easy to mistake these short-term drops for the end of a bull run. That’s why it’s crucial to look at the bigger picture and not just short-term movements. Experienced investors often talk about “buying the dip,” meaning they purchase during these short-term declines, expecting the overall upward trend to continue.

However, bull markets eventually end. This shift can be triggered by bad news, adverse legislation, or unexpected events like the COVID-19 pandemic. When investor confidence drops sharply, it can start a bear market, where falling prices cause more selling, leading to a downward spiral.

What is a Bear Market?

Bear markets are periods where supply exceeds demand, confidence is low, and prices are falling. Pessimistic investors who expect prices to continue dropping are called “bears.” Trading in a bear market can be tough, especially for beginners.

Predicting the end of a bear market and the lowest prices is notoriously difficult. The recovery process is slow and influenced by various factors, including economic conditions, investor psychology, and global events.

Opportunities in Bear Markets

Despite the challenges, bear markets can offer opportunities. Long-term investors might see falling prices as a chance to buy undervalued assets, benefiting when the market eventually rebounds. Short-term traders look for temporary price spikes or corrections.

Advanced investors might use strategies like short selling, betting that prices will fall. Another common approach is dollar-cost averaging, where you invest a fixed amount regularly, regardless of the market’s ups and downs. This strategy spreads risk and ensures you keep investing through both bull and bear markets.