Difference between Coin and Token

Cryptocurrencies encompass two main categories: coins and tokens, each with distinct characteristics and functionalities.

- Coins, such as Bitcoin (BTC) and Ethereum (ETH), operate on their own independent blockchain infrastructures. On the other hand, Tokens are created within the ecosystems of existing blockchains.

- Coins play huge role in ecosystem of blockchain and its functionality. They help in: facilitating transactions, contributing to security through mining or staking, and serving as a medium of exchange. While tokens serve similar purposes as coins, but within their respective projects. Tokens lack broader utility outside of their project. For example, tokens like UNI or other ERC-20 tokens on the Ethereum blockchain are confined to specific functionalities within their ecosystems.

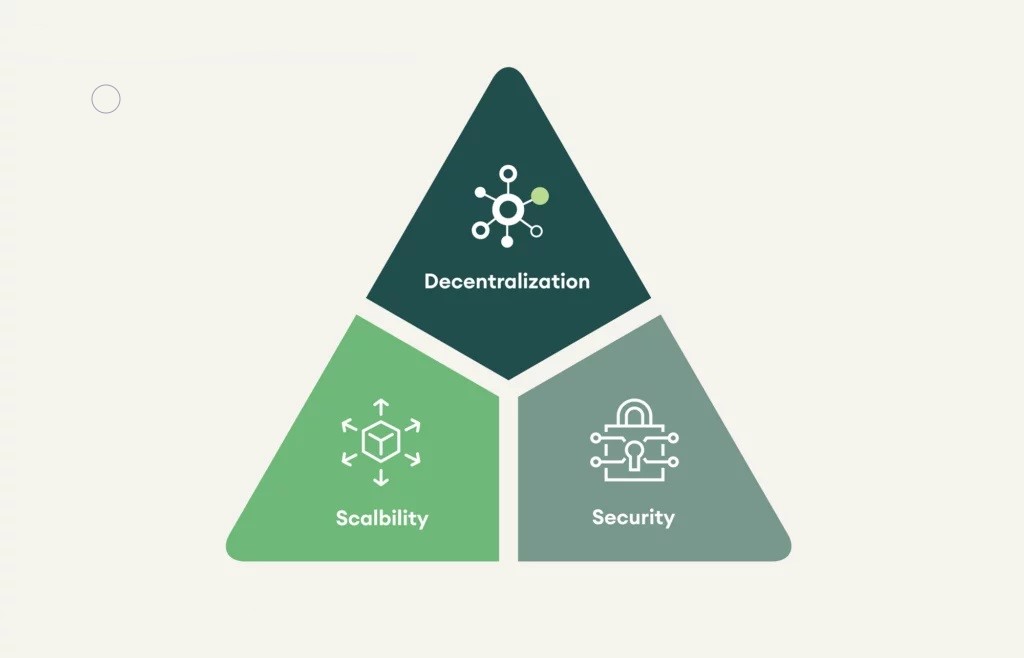

- Coins tend to offer greater security compared to tokens, as they are backed by the decentralized network of their own blockchain. In contrast, tokens may be more vulnerable to compromises in their liquidity pools or other vulnerabilities inherent in the blockchain they are built upon.

- Choosing to create a token on an existing blockchain limits the collaboration potential with other projects. As opposed to creating a new blockchain, which offers the opportunity to attract external projects and build a more extensive ecosystem. However, creating a token is way easier and provides quicker access to market on top of leveraging the existing infrastructure.

Creating Tokens vs Creating Coins

Creating Tokens:

- Utilization of Existing Tools: Token creation typically involves leveraging existing tools and open-source code, making it relatively accessible to developers.

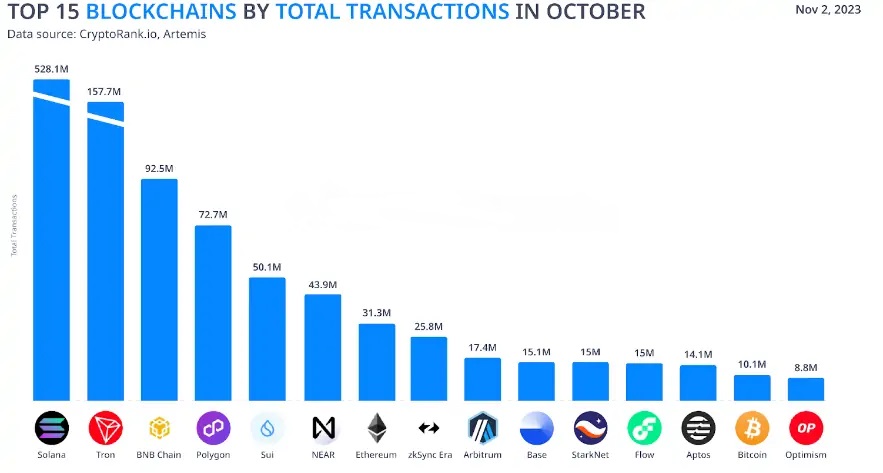

- Interaction with Parent Blockchains: Tokens operate within the ecosystems of established blockchains like Ethereum, Binance Smart Chain, Solana, and Polygon, allowing them to benefit from the security and reputation of these networks.

- Simplicity and Cost-effectiveness: Tokens are simpler and more cost-effective to create compared to coins, making them suitable for projects such as DApps, decentralized games, ICOs, and crowdfunding.

Creating Coins:

- Skilled Development Team Required: Developing a coin requires a team of skilled blockchain developers and a significant amount of time and resources.

- Ongoing Maintenance: Coins require ongoing support and maintenance to ensure the functionality and security of their respective networks.

- Potential for Greater Investment Returns: Despite the higher investment required, it may offer greater investment potential compared to tokens, as it provides complete digital sovereignty over the network.

Factors Influencing the Decision:

- Project Objectives: The decision between creating a token or a coin depends on the specific functionalities and objectives of the project. Some projects would function better as Tokens, while others as Coins.

- Financial Considerations: Both options demand financial investments and marketing efforts, but coins typically require more upfront investment.

Popular Platforms and Tools

Popular Platforms and Solutions for Token Creation:

- Binance Smart Chain, Ethereum, and Solana: These platforms offer ready-made tools and standards for token creation, such as BEP-20 and ERC-20, enabling developers to launch tokens with ease.

- Decentralized Applications (DApps): Building DApps on platforms like Ethereum and Polkadot allows for the creation of independent economies and increases the use cases for tokens.

- Chain Development Kits: Solutions like Polygon’s Chain Development Kit simplify the process of launching projects on Layer 2 solutions with minimal gas fees.

Choosing the Right Tools:

- Certified Tools for Businesses: While simple Web3 applications may suffice for individuals, businesses should opt for certified tools like the Bitbond Token Tool to ensure legality and compliance.

One Comment

Comments are closed.