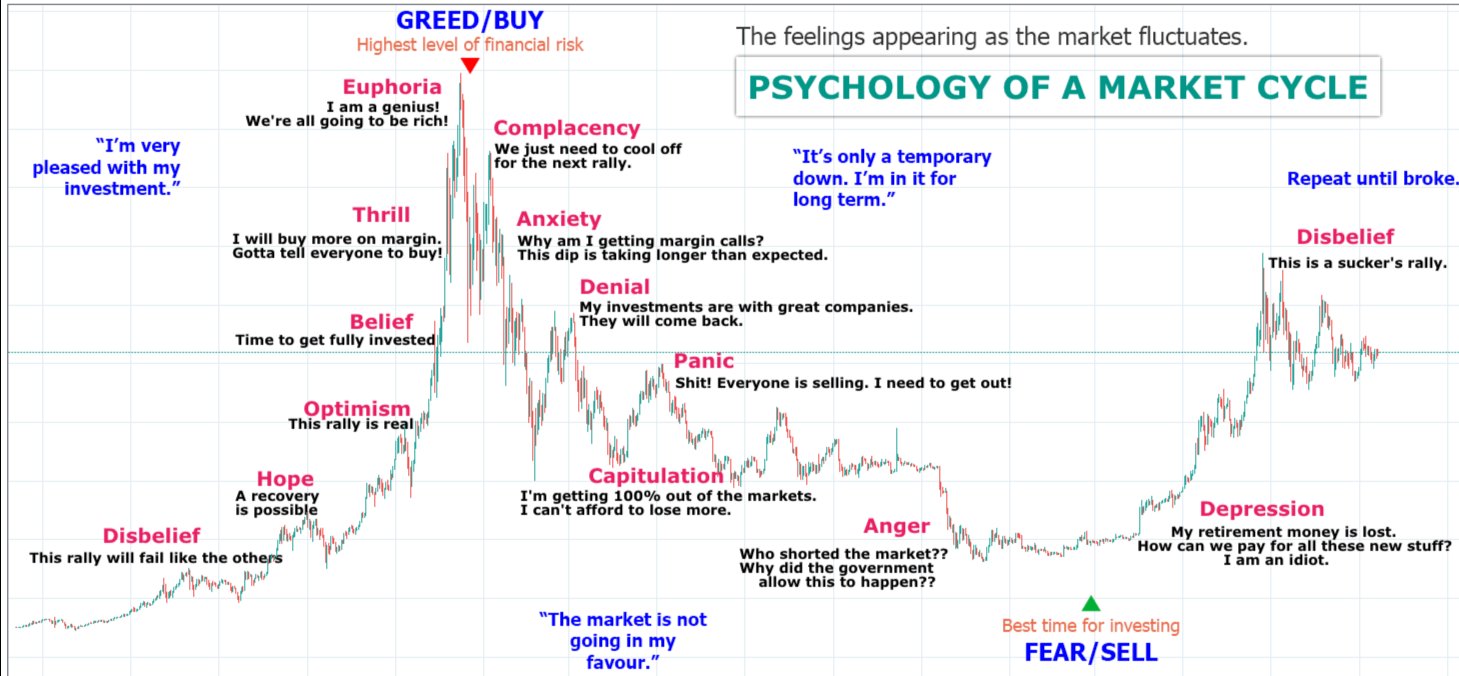

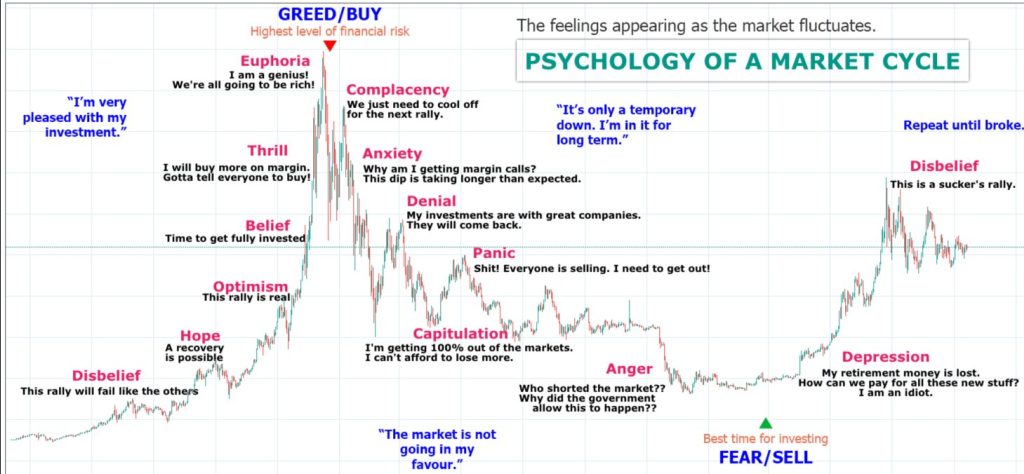

The crypto market cycle psychology involves analyzing traders’ behaviors and decisions alongside price movements and dynamics. Emotions, logical reasoning, and overthinking all play roles in how investors react to market trends, news, and price changes. By understanding these psychological stages, traders can better navigate the market and make informed decisions.

Two Rules of Using Market Cycles

Rule One: Don’t Trade with Emotions. Successful trading requires keeping emotions in check.

Rule Two: Understand Market Sentiment. Rather than following the crowd, seasoned investors analyze the overall sentiment and use it to make strategic decisions.

For example, during a market meltdown, most people tend to sell their assets. However, experienced traders often hold or even buy, knowing that overbought assets can recover, especially after thorough research.

Buy when there’s blood in the streets, even if the blood is your own

Warren Buffett

Stages of the Market Cycle Psychology

Reluctance and Disbelief: At the end of a previous meltdown, a new cycle begins with skepticism. Traders are cautious, doubting the success of the new trend as they remember past failures.

Hope and Optimism: Gradually, optimism grows. Traders start believing this trend will be different, leading to more technical analysis and strategic planning. They begin to calculate risks and potential rewards, overcoming their initial doubts.

Thrill and Euphoria: As investments start to pay off, excitement builds. This stage often coincides with a bull market where asset prices rise, and buying orders increase. Traders feel the joy of profits and resist selling, hoping for even higher returns. An example of this was Bitcoin’s surge in 2021.

Anxiety and Panic: Eventually, prices drop. This stage splits investors into doubters and believers. Doubters sell to secure profits, while believers hope for a rebound. This can lead to significant losses as overbought assets correct.

Anger and Depression: A bear market begins, marked by steep price declines. Traders sell in fear of further losses, leading to widespread anger and depression. Those with stop-loss strategies might mitigate losses, but many face substantial declines.

Recovery and Optimism: After hitting rock bottom, prices show signs of recovery. Traders cautiously start to re-enter the market, hoping for a new uptrend. However, this stage is fragile, and a premature buying spree can lead to another drop.

Reluctance and Disbelief (Again): As prices improve, skepticism returns. Investors doubt the longevity of the new trend, bringing the cycle back to the initial stage of reluctance and disbelief.

Mastering Market Cycle Trading Strategies

Traders use various strategies to navigate market cycles:

- Contrarian Approach: Sell during growth and buy during devaluation to stay ahead of market reversals.

- RSI Index: Use the Relative Strength Index to identify overbought and oversold conditions, helping predict potential price corrections.

- Position Trading: Hold positions for extended periods (months) to focus on long-term trends rather than short-term fluctuations.

By understanding these psychological stages and employing strategic trading methods, investors can better manage their crypto investments and potentially enhance their returns.