Decentralized exchanges (DEXs) have become the go-to solutions in the DeFi space, especially after the downfall of centralized exchanges like FTX. These platforms facilitate billions of dollars in crypto transactions daily, embodying the core DeFi principle of decentralizing financial services. Unlike centralized exchanges, DEXs operate without intermediaries, offering genuine decentralization. However, one significant issue that DEX users face is slippage.

What Is Slippage?

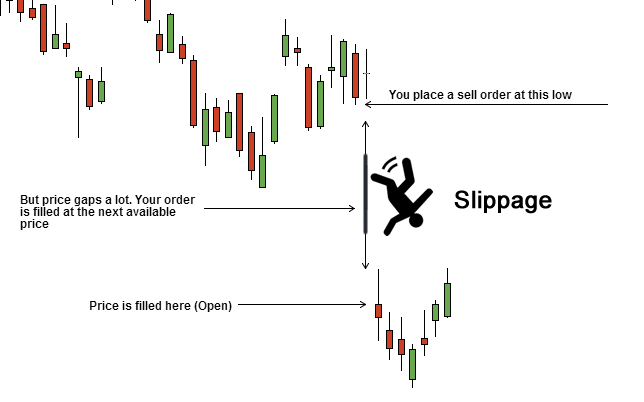

Slippage is the difference between the quoted price of a cryptocurrency and the price you actually pay when the transaction is executed. It’s a common challenge on popular DEXs like Uniswap. Slippage can impact the final amount of cryptocurrency you receive, making it a crucial factor for traders to understand and manage.

Understanding Slippage with a Simple Example

Imagine you intend to buy 40 units of a cryptocurrency at a quoted price of 2 ETH. By the time your trade is executed, market conditions might have changed, and you might only receive 39 units for the same 2 ETH. This 1-unit difference is due to slippage.

Causes of Slippage

Slippage occurs because of the delay between the time a trader initiates a transaction and when it gets executed. During this delay, market prices can fluctuate. DEXs provide a quoted price based on current market conditions, but the final price can differ due to these fluctuations. Traders can set a slippage tolerance—if the slippage exceeds this threshold, the transaction will be canceled.

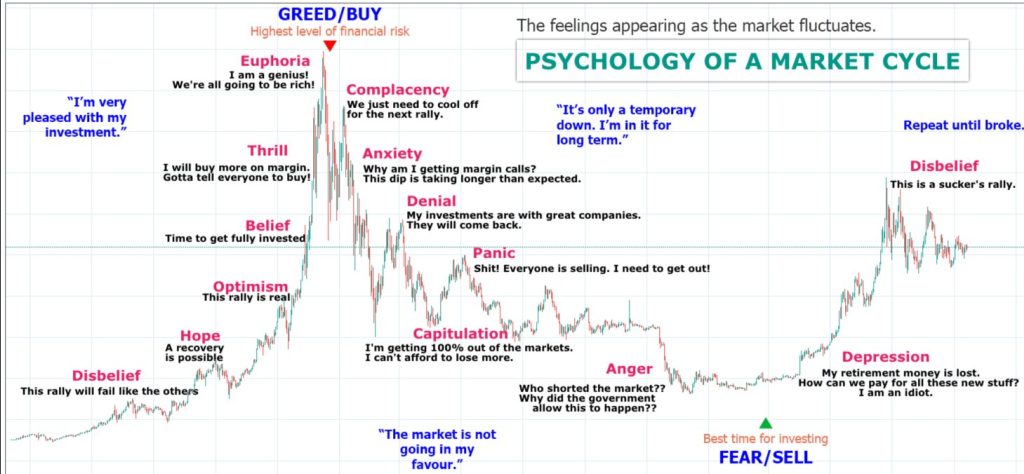

Slippage can be positive or negative:

- Negative Slippage: The final price is worse than the quoted price.

- Positive Slippage: The final price is better than the quoted price.

How to Minimize Slippage

1. Pay for Faster Transaction Approval

Slippage is more likely when block space is limited, and transaction volumes are high. Transactions with low gas fees might take longer to process, increasing the risk of price changes. Paying higher gas fees can speed up transaction approval, reducing the chance of slippage.

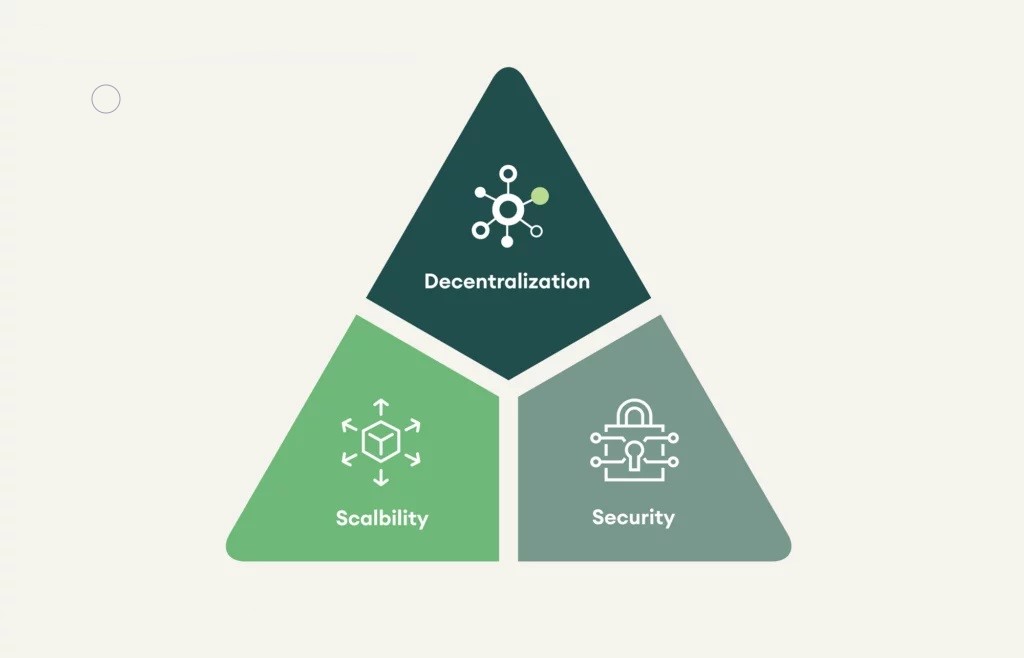

2. Use Layer 2 Solutions

While higher gas fees can mitigate slippage, they also make transactions more expensive. Layer 2 scaling solutions offer a more cost-effective alternative. These solutions, such as rollups, process transactions off the main Ethereum chain, providing faster and cheaper transaction confirmations.