Liquidity

Liquidity pools are probably the most important aspect of decentralized finance (DeFi). They serve as a store of tokens or other digital assets, locked within smart contracts to facilitate liquidity on decentralized exchanges (DEXs).

In trading, there’s often a gap between what you expect to pay and what you actually pay. This happens in both traditional and crypto markets. Liquidity pools aim to fix this issue by rewarding users and ensuring there’s enough liquidity to cover trading fees.

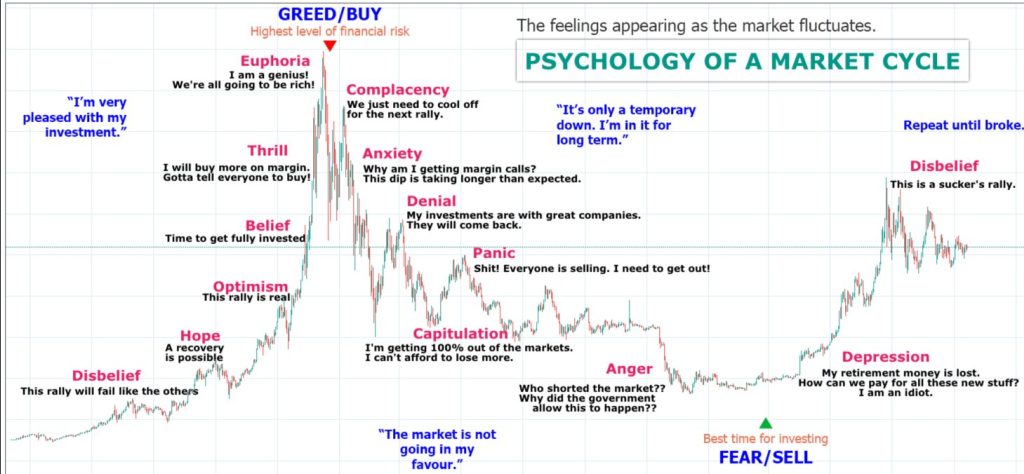

What is Liquidity: In simple terms, liquidity refers to the ease with which assets can be converted into cash without causing significant price fluctuations. Illiquid assets take longer to convert and incur slippage, where the selling price differs from the intended price. So, trader ends up losing additional amount of money during selling process.

While traditional exchanges relies on buyers and sellers to provide liquidity, DeFi relies on liquidity pools to operate efficiently. These pools serve as the lifeblood of DEXs, ensuring their survival and functionality.

How Liquidity Pools Work

What is Liquidity Pool: It’s essentially a digital reservoir of cryptocurrency locked within a smart contract, enhancing liquidity for faster transactions. Automated market makers (AMMs) are a vital component of liquidity pools, enabling automated trading of digital assets based on predetermined mathematical formulas rather than traditional buyer-seller markets.

Liquidity pools can be compared to having multiple cashiers in a fast-food restaurant, enabling swift transactions and keeping customers satisfied. On the other hand, a lack of liquidity resembles a single cashier with a long queue, resulting in slower transactions and customer dissatisfaction.

Here’s how it works in simplest terms: Users contribute tokens to liquidity pools on AMM platforms, and the pool’s token price is determined by the AMM’s algorithm. That’s all there is.

Liquidity pools are not only crucial for trading but also play a significant role in yield farming and blockchain-based games. Reason is, both requires automated market maker, and for that to work you need liquidity pool system in place.

Liquidity Providers

Liquidity pools incentivize liquidity providers (LPs) who supply assets to the pools. LPs receive rewards in the form of fees and incentives proportional to the liquidity they contribute, earning liquidity provider tokens (LPTs) over time, which can have their own use cases too.

Liquidity Providers could also be incentivized through Yield Farming. This allows them to earn high returns for taking on slightly higher risk by spreading their funds across trading pairs.

How Does a Liquidity Pool Operate?

As mentioned, a liquidity pool encourages users to stake their digital assets. Rewards can be in the form of crypto or a share of trading fees. For instance, let’s say a trader invests $20,000 in a BTC-USDT liquidity pool using Uniswap.

Here’s how it works:

- Visit Uniswap.

- Locate the BTC-USDT liquidity pool.

- Deposit an equal amount of BTC and USDT into the pool (in this case, $10,000 each).

- Receive BTC-USDT liquidity provider tokens (LP Token).

- Stake the LP tokens in the BTC-USDT staking pool.

- Receive UNI tokens as rewards after the agreed lockup period.

The original BTC-USDT pair earns a portion of the fees from exchanges on that liquidity pool. Additionally, you’d earn SUSHI tokens for staking your LP tokens.

Popular Liquidity Pool Providers

Uniswap: Lets users trade ETH for any ERC-20 token without a centralized service.

Balancer: Offers various pooling options like private and shared liquidity pools.

Curve: A decentralized liquidity pool for stablecoins on the Ethereum network.

Pros and Cons of Liquidity Pools

Pros:

- Enable users to provide liquidity and earn rewards, interest, or annual percentage yields on their crypto.

- Use publicly viewable smart contracts to maintain transparency.

- Simplify DEX trading by executing transactions at real-time market prices.

Cons:

- Exposure to impermanent loss, where price changes in locked-up assets result in unrealized losses compared to holding the assets in a wallet.

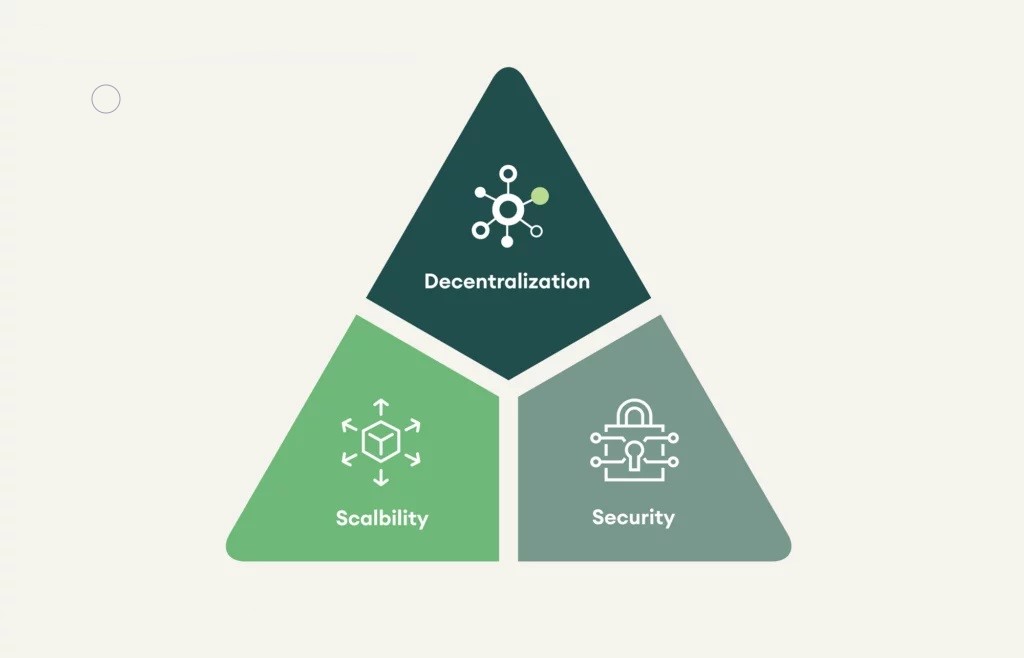

- Control of funds by a small group, going against decentralization.

- Risk of hacking exploits due to poor security protocols, leading to losses for liquidity providers.

2 Comments

Comments are closed.